This is my Weekly Markups on EURUSD for 10 NOV 2025 W46 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Market Sentiment

The overall market sentiment is leaning risk-off, with investors favoring safe-haven assets like the US Dollar amid uncertainties from a prolonged US government shutdown and mixed global economic signals. This cautious mood is weighing on the Euro, as it reflects broader worries about slower growth in the Eurozone, while bolstering the Dollar as a reliable store of value during times of instability. Key drivers include diverging central bank policies: the European Central Bank (ECB) is holding rates steady at 2.00% with a dovish tilt, signaling readiness for further easing if growth falters, while the Federal Reserve (Fed) has delivered multiple rate cuts in 2025 but remains data-dependent, creating a narrowing interest-rate gap that limits Dollar strength. Recent US labor data, such as softer Challenger Job Cuts, has heightened expectations for another Fed cut in December, adding to Dollar caution, alongside Eurozone industrial production misses and steady inflation near the ECB’s 2% target.

The EUR/USD pair weakened slightly on November 9, extending a three-week downtrend as risk-off flows amplified Euro pressures from sluggish regional growth and political strains in major economies like Germany and France. The Euro is facing headwinds because the ECB’s pause on cuts highlights persistent low inflation and weak demand, making it vulnerable to further policy softening, while the Dollar is finding some support from its safe-haven status despite Fed easing signals that temper aggressive gains. This narrative of Eurozone fragility versus US resilience—fueled by delayed economic data from the shutdown and resilient US services activity—suggests the pair could test lower supports if upcoming GDP and sentiment releases disappoint, though a surprise Fed dovishness might offer brief relief.

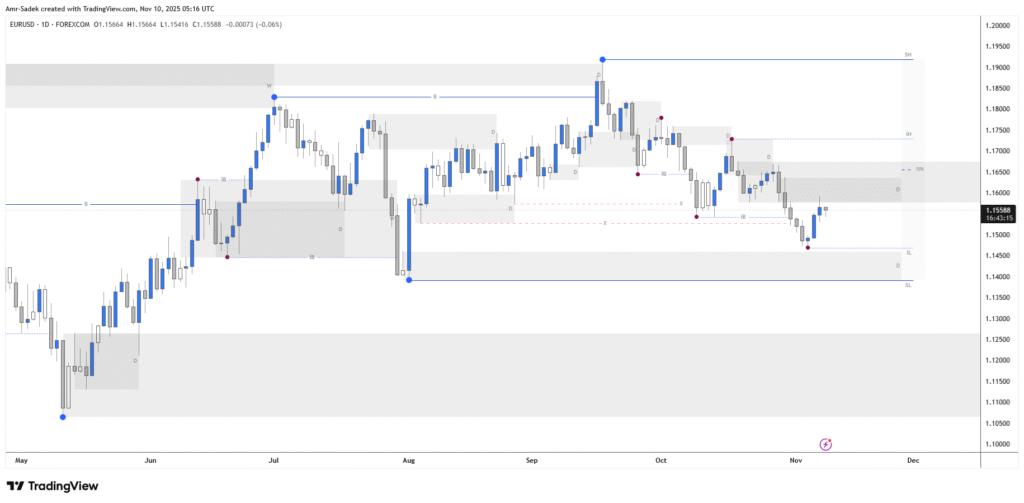

Daily Chart Markups

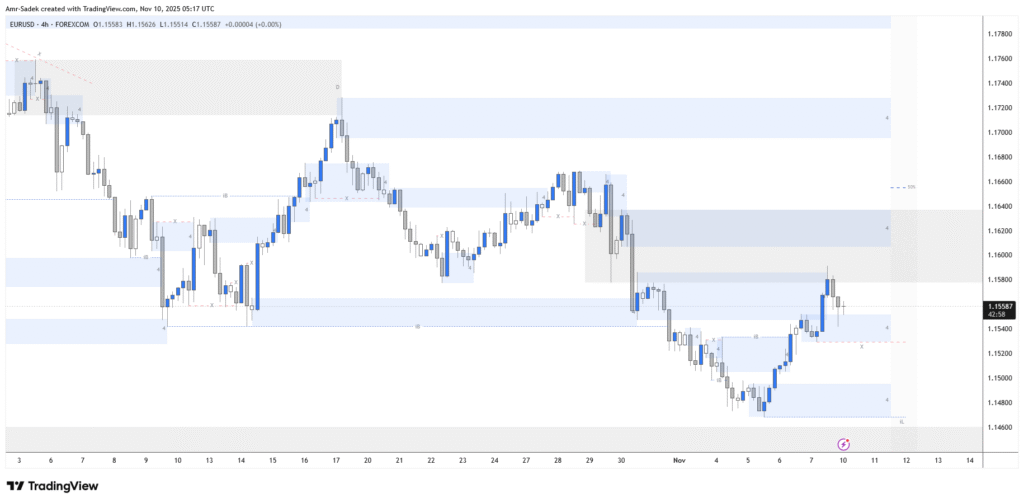

4H Chart Markups

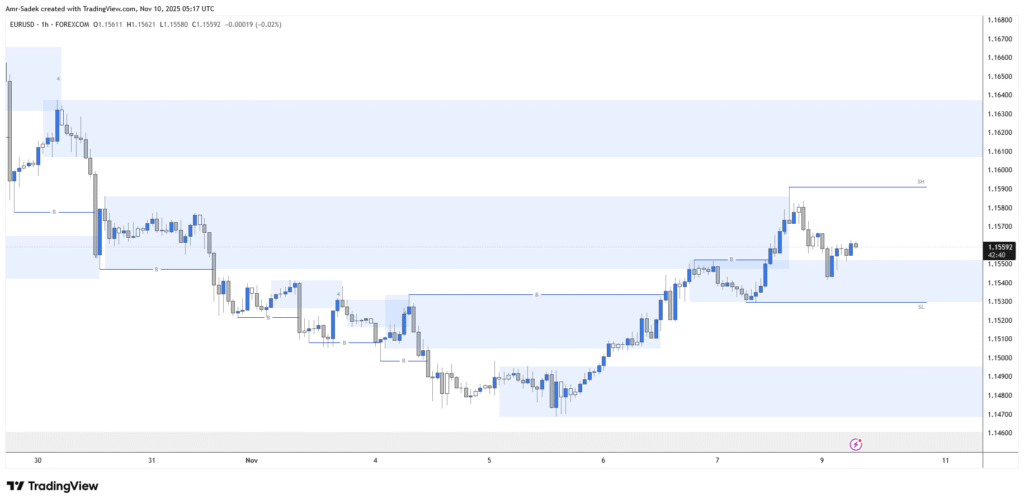

1H Chart Markups

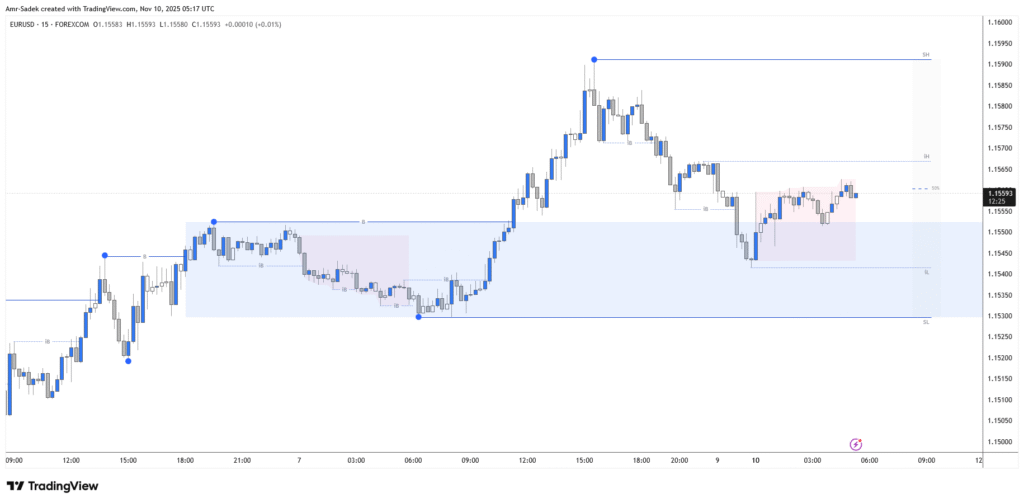

15m Chart Markups

Related Posts

- EURUSD 10-14 NOV 2025 W46 – Weekly Markups

- EURUSD 7 NOV 2025 W45 – Intraday Markups

- EURUSD 5 NOV 2025 W45 – Intraday Markups – EU PPI & US ADP

- EURUSD 4 NOV 2025 W45 – Intraday Markups – EU Lagarde Speech

- EURUSD 3 NOV 2025 W45 – Intraday Markups