This is my Weekly analysis on EURUSD for 20-24 Jan 2025 W4 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Market Sentiment

- Interest Rate Differentials: The widening gap between US and Eurozone interest rates favors the USD. Higher US yields attract capital flows, supporting the USD against the euro.

- Inflation Trends: While inflation in the Eurozone remains subdued, the US continues to grapple with sticky inflation, keeping the Fed cautious about easing policy. This divergence further supports the USD.

- Energy Prices: Elevated energy prices, driven by geopolitical tensions or supply disruptions, could weigh on the Eurozone’s trade balance and economic growth, adding pressure to the euro.

Weekly Chart Analysis

1️⃣

🔹Swing Bearish

🔹Internal Bearish

🔹In Swing Discount

🔹Swing Continuation Phase (Pro Swing + Pro Internal)

2️⃣

🔹INT structure continuing bearish with iBOS following the Bearish Swing. (End of 2023 till end of 2024 was a pullback phase after the first bearish iBOS)

3️⃣

🔹After the bearish iBOS we expect a pullback, price tapped into liquidity below Nov 2022 which is above the weekly demand formed with the initiation of the bearish iBOS pullback phase.

🔹Expectations is for price to start a pullback phase from the Weekly demand zone / or from the liquidity sweep from the Nov 2022 low (Require Daily/4H confirmation).

Daily Chart Analysis

1️⃣

🔹Swing Bearish

🔹INT Bearish

🔹Swing Continuation Phase (Pro Swing + Pro Internal)

2️⃣

🔹Following the Bearish Swing BOS, INT Structure continuing bearish approaching the weekly demand zone.

3️⃣

🔹After the receint iBOS, price pulled back to EQ (50%) of the INT Structure but currently failed to create a new iBOS with a Bullish CHoCH forming a new Demand.

🔹Expectations is not clear as we could start a deep pullback to intiate the Weekly Pullback Phase required or the current failure to creare a new Bearish iBOS is just a pause in market for more bearish move to at least the Weekly Demand. More development required from LTFs.

4H Chart Analysis

1️⃣

🔹Swing Bearish

🔹Swing Continuation Phase (Pro Swing + Pro Fractal)

2️⃣

🔹After the Bearish BOS, price pulled back to the Swing EQ (50%) tapping into a Daily and a 4H Supply that caused a Bearish CHoCH and forming a Supply that price is contained within it.

3️⃣

🔹Price is currently ranging between Supply and Demand which clearly makes price indecisively have a clear direction. More developments required on LTFs to have a clear expectation.

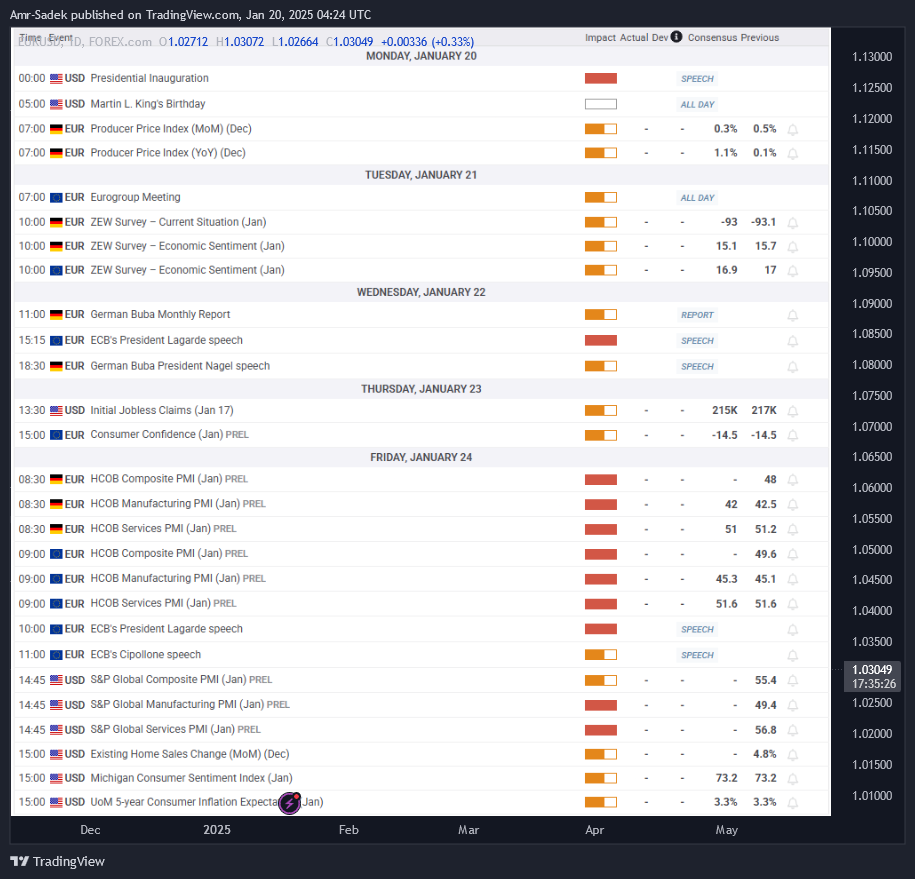

Economic Events for the Week

Link to Tradingview Post: https://www.tradingview.com/chart/EURUSD/17XmuSQG-EURUSD-20-24-Jan-2025-W4-Weekly-Analysis/