This is my Weekly Markups on EURUSD for 11 NOV 2025 W46 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Market Sentiment

Market sentiment has leaned toward risk-on in recent sessions, with investors showing renewed appetite for equities and higher-yielding assets amid optimism over the U.S. government’s reopening after a prolonged shutdown. This environment has softened the U.S. dollar as a safe-haven currency, giving the euro some breathing room despite ongoing concerns about sluggish Eurozone growth. The dominant drivers include diverging central bank policies—the ECB holding its deposit rate steady at 2% for the third straight meeting to support moderate inflation around 2%, while the Fed continues easing with potential additional cuts fueled by weak private labor data showing record job cut announcements—and the resolution of U.S. political gridlock, which eases short-term uncertainty but highlights delayed economic reports that could sway future policy.

The EUR/USD pair experienced a modest strengthening on November 10, edging higher as dollar weakness from these risk-on flows and Fed easing expectations outweighed Eurozone headwinds like persistent manufacturing declines and external trade pressures. The euro is finding temporary support because the ECB’s pause in rate cuts signals confidence in steady inflation and growth, reducing fears of aggressive easing that could further erode its value. Meanwhile, the dollar is under pressure due to the shutdown’s fallout, including stalled data releases that amplify bets on more Fed cuts to bolster a softening labor market, though any hawkish signals from upcoming inflation figures could quickly reverse this dynamic and cap the pair’s upside.

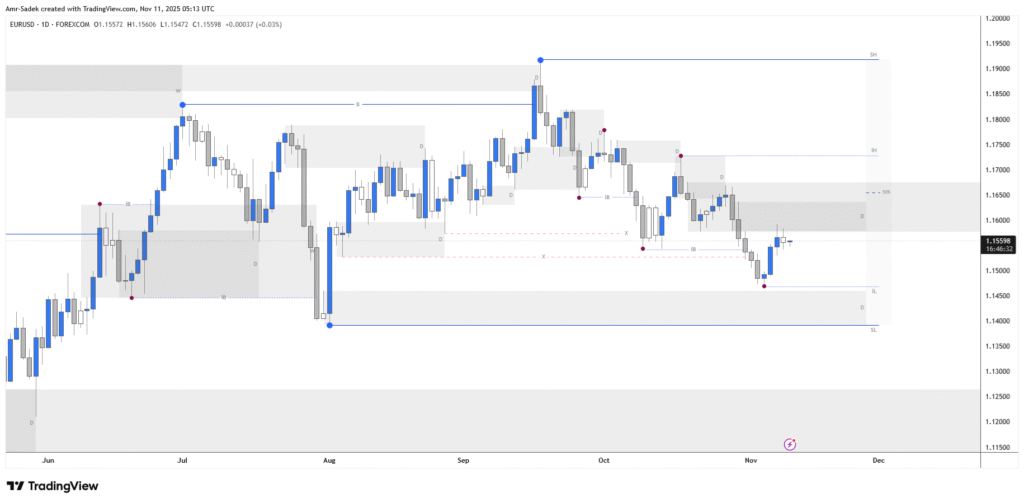

Daily Chart Markups

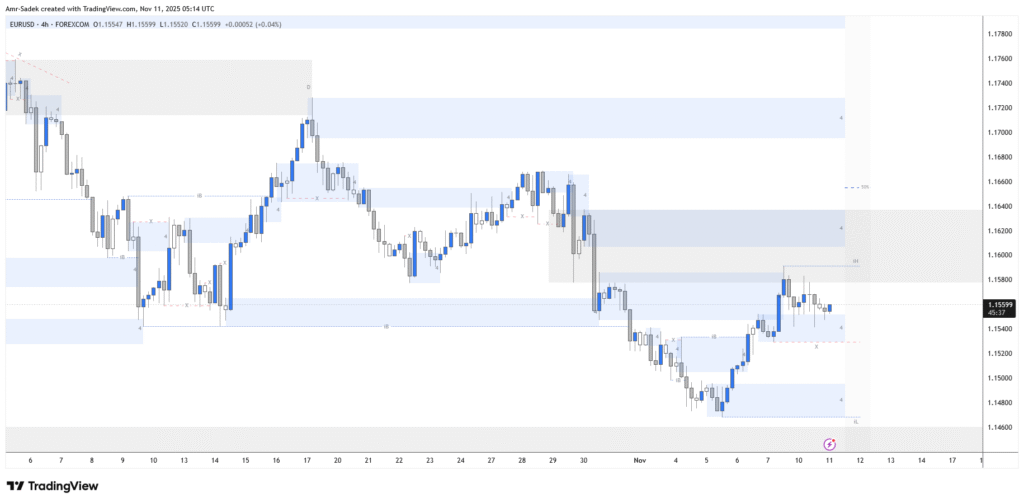

4H Chart Markups

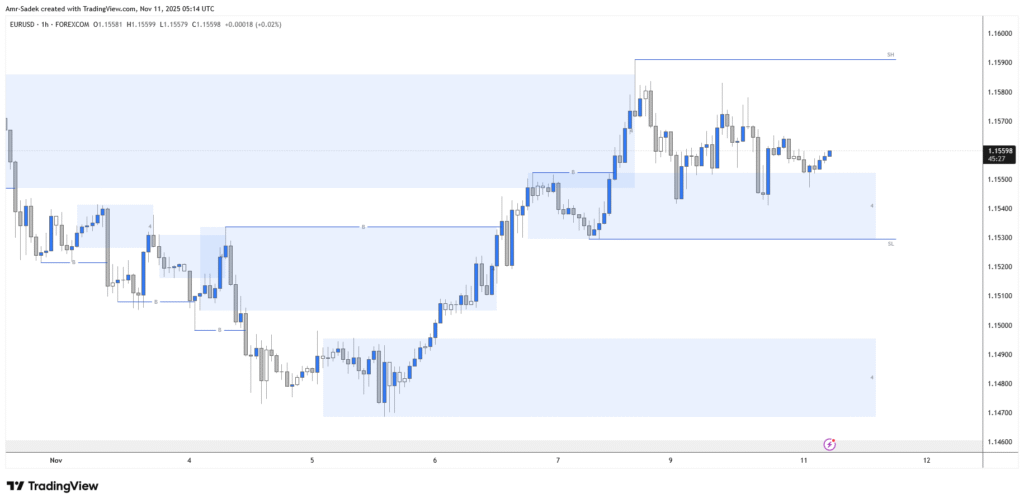

1H Chart Markups

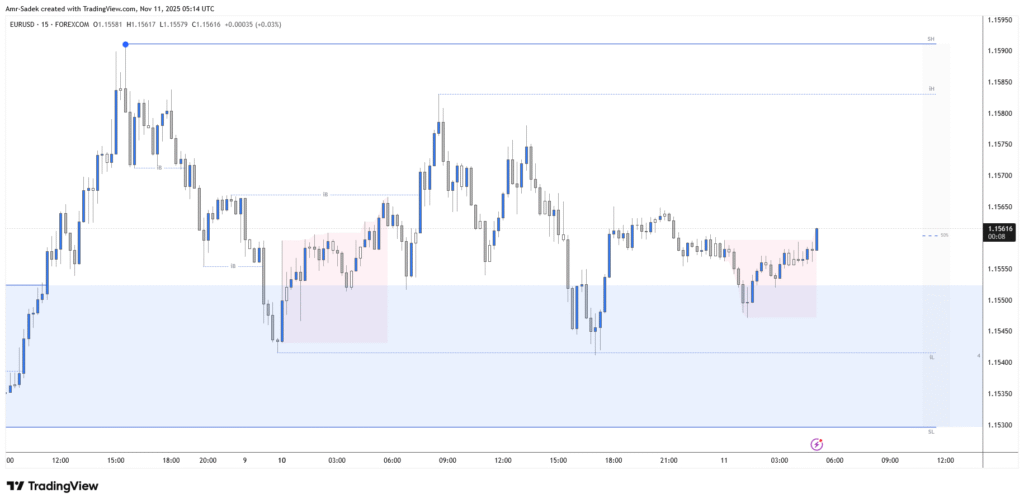

15m Chart Markups

Related Posts

- EURUSD 10 NOV 2025 W46 – Intraday Markups

- EURUSD 10-14 NOV 2025 W46 – Weekly Markups

- EURUSD 7 NOV 2025 W45 – Intraday Markups

- EURUSD 5 NOV 2025 W45 – Intraday Markups – EU PPI & US ADP

- EURUSD 4 NOV 2025 W45 – Intraday Markups – EU Lagarde Speech