This is my Weekly Markups on EURUSD for 20 OCT 2025 W43 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Market Sentiment

Market sentiment remains risk-off, with investors favoring safe-haven assets like the US Dollar due to rising geopolitical tensions and economic uncertainties, while the Euro struggles as a currency tied to global trade and growth. The dominant themes include intensifying US-China trade disputes, with new tariff threats raising fears of disrupted global markets, and political instability in Europe, particularly France’s ongoing budget standoff and Germany’s uncertain pre-election landscape. Central bank policies continue to diverge: the ECB is maintaining steady rates, supported by inflation holding near 2% and slightly upgraded 2025 growth forecasts, while the Fed is poised for a November rate cut as US labor markets cool, though strong consumer spending and sticky inflation limit aggressive easing expectations. Recent data showing robust US retail sales and weaker Eurozone PMI figures reinforce this economic split, with upcoming US CPI data on October 24 adding to market focus.

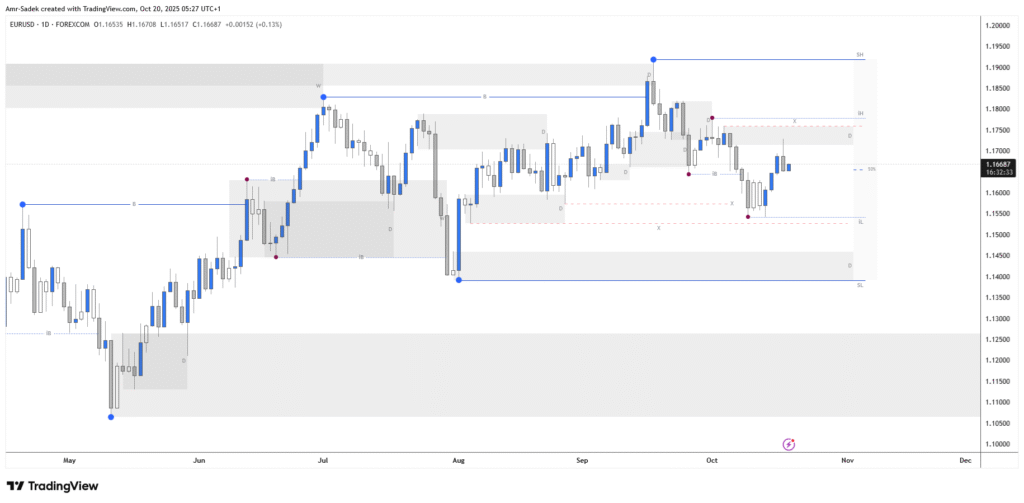

Daily Chart Markups

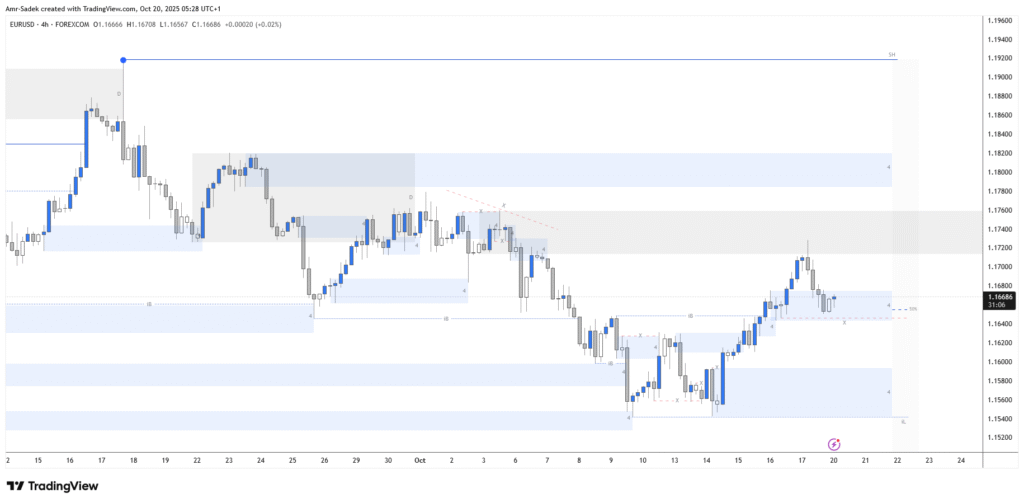

4H Chart Markups

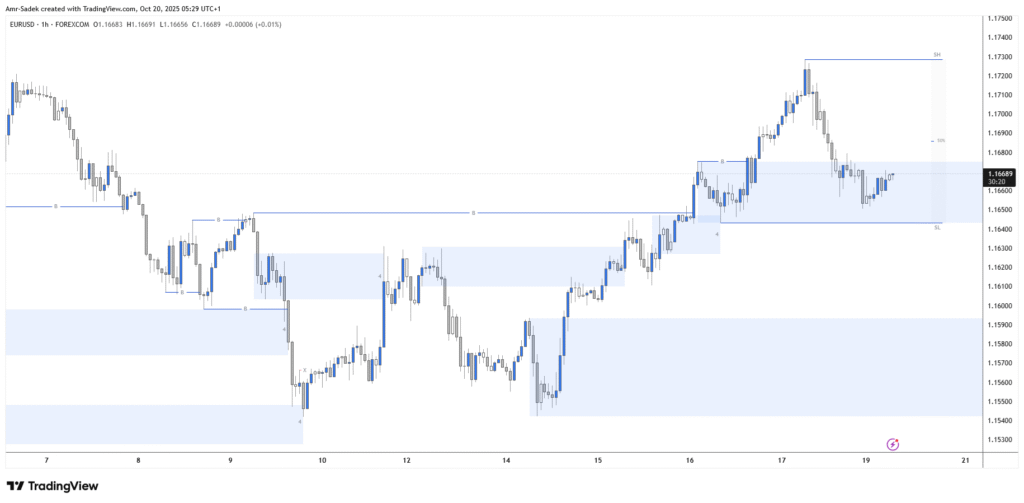

1H Chart Markups

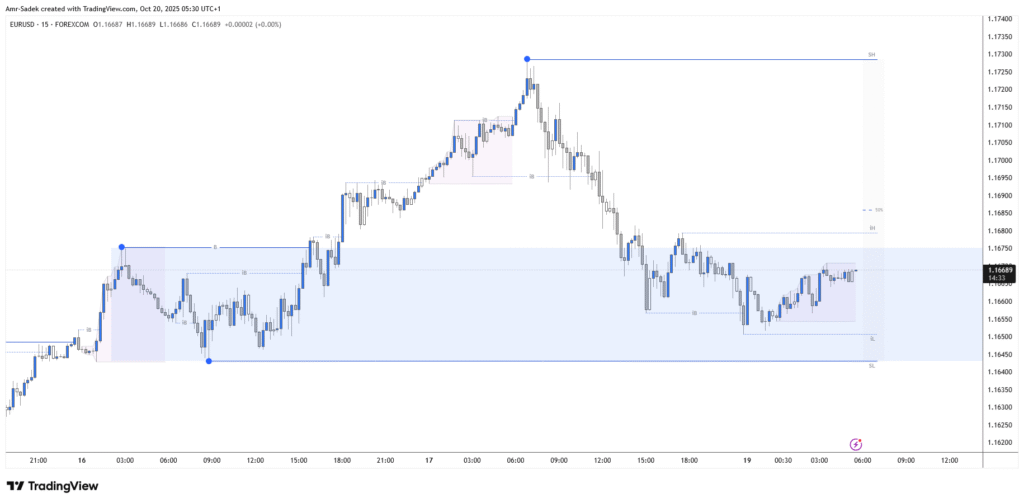

15m Chart Markups

Related Posts

- EURUSD 17 Oct 2025 W42 – Intraday Markups – EU CPI

- EURUSD 16 Oct 2025 W42 – Intraday Markups – EU Trade Balance & US Fed speakers

- EURUSD 15 Oct 2025 W42 – Intraday Markups – US Beige Book

- EURUSD 14 Oct 2025 W42 – Intraday Markups – EU ZEW & US Powell Speaks

- EURUSD 13 Oct 2025 W42 – Intraday Markups