This is my Weekly Markups on EURUSD for 22 OCT 2025 W43 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Market Sentiment

The mood in global markets is mildly risk-on: headlines about possible de-escalation of U.S.–China trade tensions and stable earnings from large U.S. banks have nudged investors toward shares and away from the safest assets. In this climate the euro has received only modest help, while the U.S. dollar is softening on reduced safe-haven demand. The dominant theme, however, is central-bank divergence. The European Central Bank is expected to stay on hold for the foreseeable future after a run of disappointing data—highlighted by Germany’s third straight monthly drop in producer prices—while the Federal Reserve is still seen delivering at least one more rate cut before year-end. That gap in expected returns continues to attract flows toward the dollar, capping the euro’s ability to rally.

The euro is struggling because the market worries that persistently weak factory-gate prices in Germany signal broader disinflation across the euro-area, reinforcing the ECB’s cautious tone and lowering the chance of any near-term hike. At the same time, the dollar is finding a floor: even though Fed officials have talked down the pace of further cuts, U.S. yields remain comfortably above their European counterparts and the regional-bank stress that flared last week has eased. Put together, the narrative is “softer European growth and inflation vs. a still-resilient U.S. backdrop,” a mix that leaves EUR/USD biased lower unless upcoming data show a revival in euro-area activity or a marked U.S. slowdown.

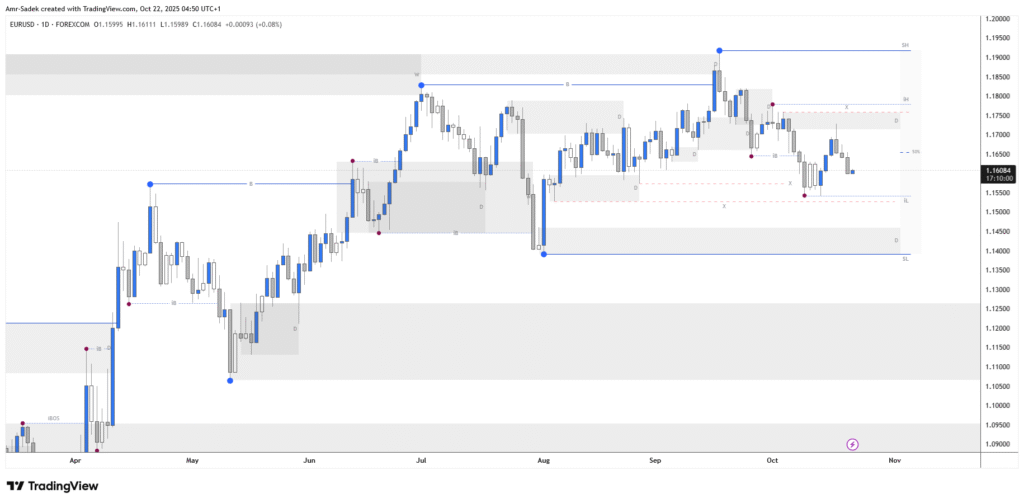

Daily Chart Markups

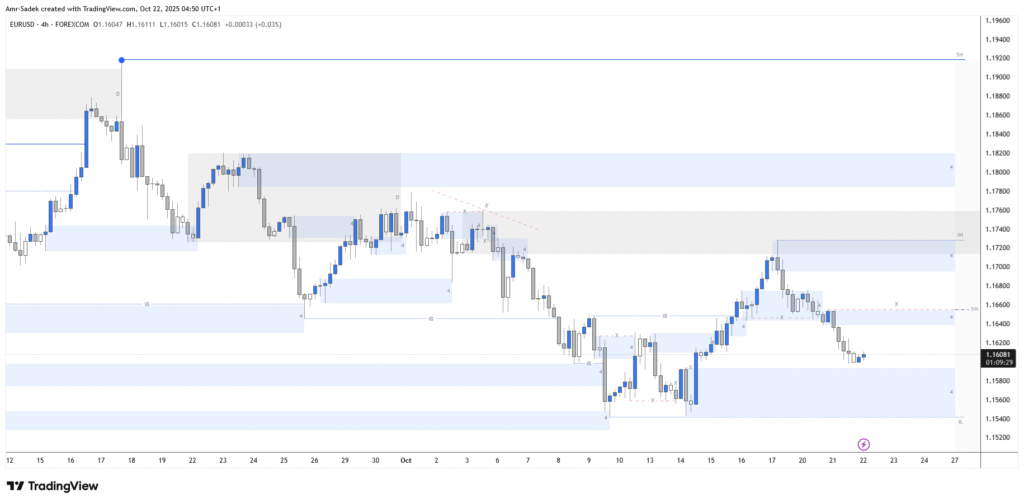

4H Chart Markups

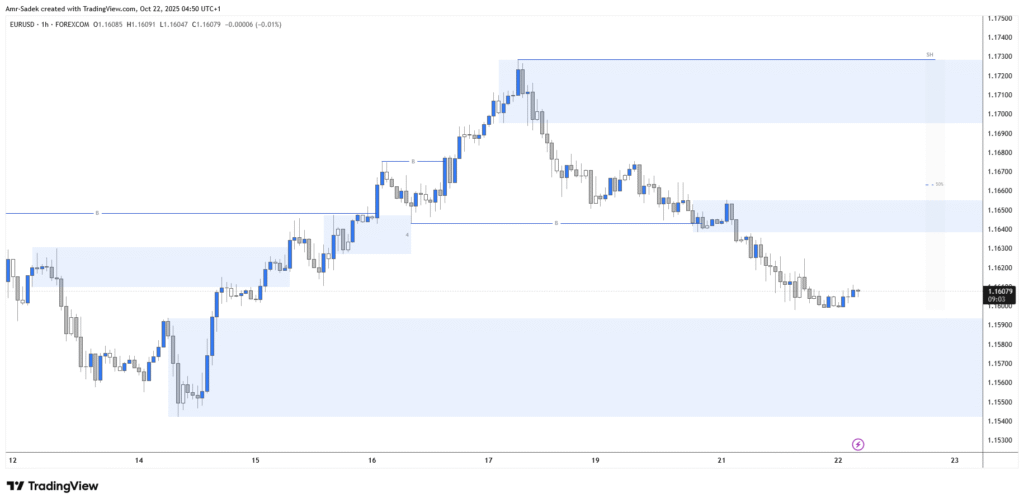

1H Chart Markups

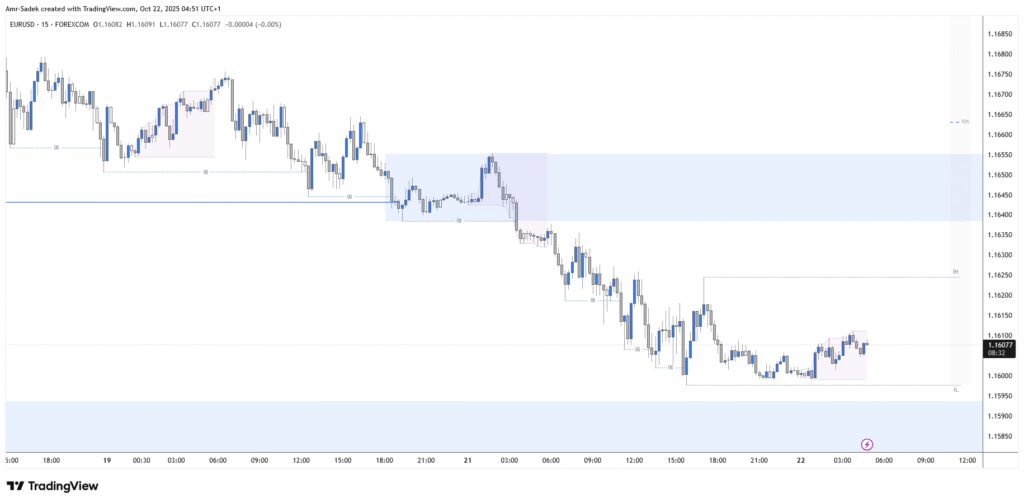

15m Chart Markups

Related Posts

- EURUSD 21 Oct 2025 W43 – Intraday Markups – EU Lagarde Speaks

- EURUSD 20 Oct 2025 W43 – Intraday Markups

- EURUSD 20-24 Oct 2025 W43 – Weekly Markups

- EURUSD 17 Oct 2025 W42 – Intraday Markups – EU CPI

- EURUSD 16 Oct 2025 W42 – Intraday Markups – EU Trade Balance & US Fed speakers