This is my Intraday analysis on EURUSD for 30 Jan 2025 W5 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Market Sentiment

- Federal Reserve’s Decision: The Fed maintained the federal funds rate at 4.25% to 4.50%, citing stable economic growth and a low unemployment rate.

- Fed’s Outlook: Chair Powell emphasized a cautious approach, indicating no immediate plans to adjust rates and highlighting the need to assess the economic impacts of forthcoming policies from the Trump administration.

- Presidential Response: President Donald Trump criticized the Fed’s decision, attributing ongoing inflation issues to the central bank’s policies and pledging to address inflation through measures such as enhancing energy production, deregulation, and trade adjustments.

- Heavy Economic Reports today: Starting with EUR Unemployment, GDP, ECB Interest Rate / Lagarde Press Conference to US GDP and Core PCE.

Overall, the market sentiment reflects a blend of caution and anticipation as investors monitor the interplay between the Federal Reserve’s monetary policy and the administration’s fiscal initiatives.

4H Chart Analysis

1️⃣

🔹Swing Bullish

🔹INT Bullish

🔹Swing Continuation after BOS

2️⃣

🔹INT structure continuing bullish after the bullish BOS. We expect that at anytime the Swing Pullback will start.

🔹With price failing to close above Weak INT High, there is a HP that we are going to target the INT Low which will facilitate the Bullish Swing Pullback.

🔹Price is currently mitigating the large 4H Demand zone but failing till now to do something significant (At least a Bullish CHoCH).

3️⃣

🔹Expectation is set for price to continue Bearish to target the Strong INT Low to facilitate the 4H Bullish Swing Pullback and the Daily Bearish Continuation.

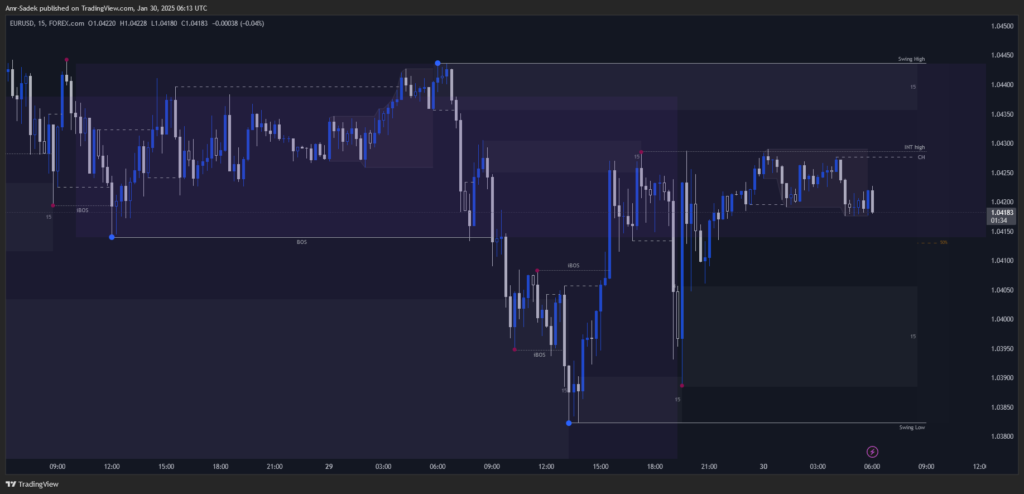

15m Chart Analysis

An update to the 15m charting as i missed a CHoCH that showed some formation for the INT structure

1️⃣

🔹Swing Bearish

🔹Swing Continuation

2️⃣

🔹Swing is continuing bearish with a new bearish BOS.

🔹After a BOS we expected a pullback which already reached the Swing Premium and mitigated the 15m / 4H supply zones.

🔹No clear INT structure within the Swing but the Fractal is currently bearish indicating the bearish swing pullback could be over and we are currently forming the Swing continuation phase to target the weak Swing Low.

3️⃣

🔹Expectation is for price to continue bearish (4H INT low to be broken) but to be cautious that we still within the 4H demand that is not fully mitigated.

Link to Tradingview Post: https://www.tradingview.com/chart/EURUSD/KjX13mxz-EURUSD-30-Jan-2025-W5-Intraday-Analysis-ECB-Rate-Lagarde/

Related Posts

- EURUSD 29 Jan 2025 W5- Intraday Analysis – US Interest Rate / Powell Conference

- EURUSD 28 Jan 2025 W5- Intraday Analysis – US Durable Goods & Consumer Confidence

- EURUSD 27 Jan 2025 W5- Intraday Analysis – ECB Lagarde / US Home Sales

- EURUSD 27-31 Jan 2025 W5 – Weekly Analysis – EU&US Interest Rate, FOMC and PCE

- EURUSD 20-24 Jan 2025 W4 – Weekly Analysis