This is my Weekly Markups on EURUSD for 4 NOV 2025 W45 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Market Sentiment

The market is leaning toward a risk-off mood, where investors favor safe-haven assets like the US Dollar over the Euro, driven by worries over global trade tensions and uneven economic growth. This setup weakens the Euro as traders pull back from riskier bets on European assets, while bolstering the Dollar as a go-to refuge. Key forces at play include the Federal Reserve’s recent hawkish tone, signaling fewer interest rate cuts ahead due to solid US job and growth figures, contrasting with the European Central Bank’s more cautious approach amid sluggish Eurozone manufacturing output. Recent data showed Eurozone factory activity barely holding steady, while US reports pointed to a resilient economy, amplifying the policy gap. Ongoing US government shutdowns add uncertainty but haven’t dented the Dollar’s strength yet, with trade policy risks from potential tariffs looming large.

The EUR/USD pair has weakened recently because the Euro is under strain from the ECB’s readiness to ease policy further if growth stalls, making it less appealing compared to the Dollar’s higher yields. Meanwhile, the Dollar draws steady support from the Fed’s patient stance on rates, backed by upbeat economic signals that reduce the urgency for deeper cuts. This creates a straightforward story: the Euro bears the brunt of Eurozone slowdown fears and softer inflation trends, while the Dollar rides a wave of confidence in US resilience and protective trade measures. If these dynamics hold, expect the pair to face more downward pressure unless fresh Eurozone data surprises to the upside.

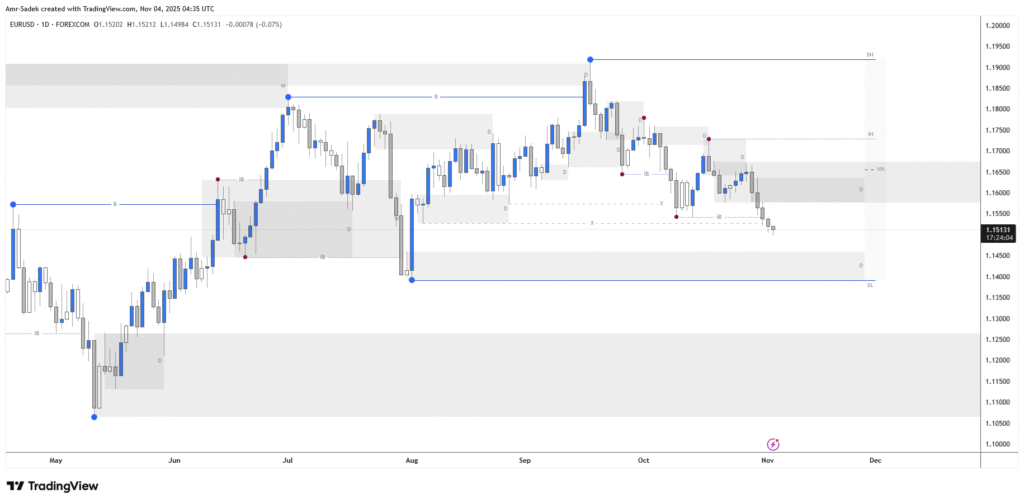

Daily Chart Markups

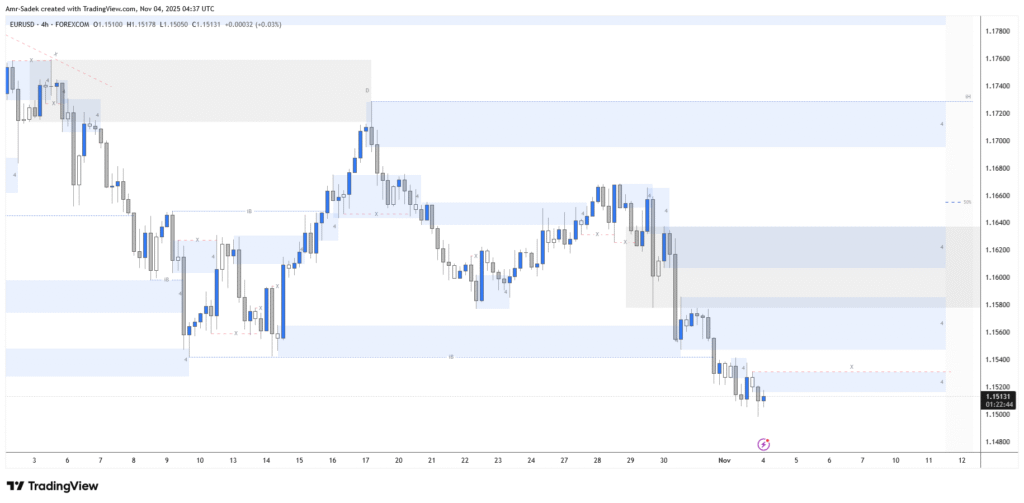

4H Chart Markups

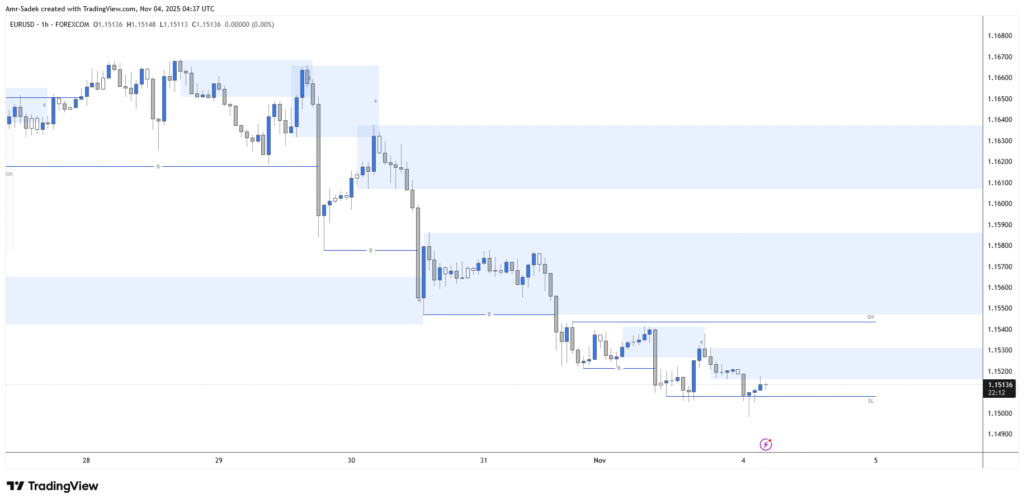

1H Chart Markups

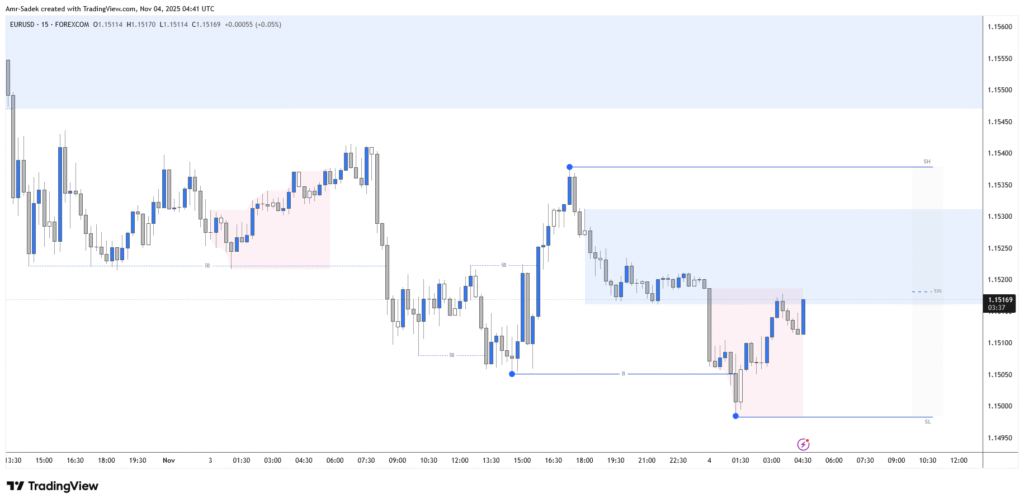

15m Chart Markups

Related Posts

- EURUSD 3 NOV 2025 W45 – Intraday Markups

- EURUSD 27-31 Oct 2025 W44 – Weekly Markups – EU & US Rate Decisions Week

- EURUSD 20-24 Oct 2025 W43 – Weekly Markups

- EURUSD 23 Oct 2025 W43 – Intraday Markups

- EURUSD 22 Oct 2025 W43 – Intraday Markups – EU Lagarde Speaks