This is my Weekly Markups on EURUSD for 5 NOV 2025 W45 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Market Sentiment

The market is leaning toward a risk-off sentiment, where investors favor safe-haven assets like the US Dollar over riskier ones like the Euro. This cautious mood is weighing on the Euro, making it harder for the currency to gain ground, while bolstering the Dollar as a go-to choice during uncertain times. Key drivers include diverging central bank policies: the European Central Bank (ECB) is seen as likely to cut rates further to support a sluggish Eurozone economy, while the Federal Reserve (Fed) has adopted a more measured approach after a recent 0.25% rate cut, with officials signaling fewer future reductions amid sticky US inflation. Recent weak Eurozone data, such as softer growth figures, adds to the pressure, alongside ongoing political instability in major economies like Germany and France.

The EUR/USD pair has weakened recently, with the Euro losing ground against a firmer Dollar as traders digest the Fed’s less dovish stance and persistent US economic resilience. The Euro is facing pressure because the ECB’s expected easing path highlights the region’s slower recovery and higher inflation risks from energy costs, eroding confidence in the currency. Meanwhile, the Dollar is finding support due to the Fed’s hawkish tilt and robust US indicators that reduce the urgency for aggressive rate cuts, drawing in flows from global investors seeking stability. This contrast paints a narrative of a resilient US economy outpacing a vulnerable Eurozone, potentially keeping downward momentum alive unless fresh Eurozone data surprises to the upside.

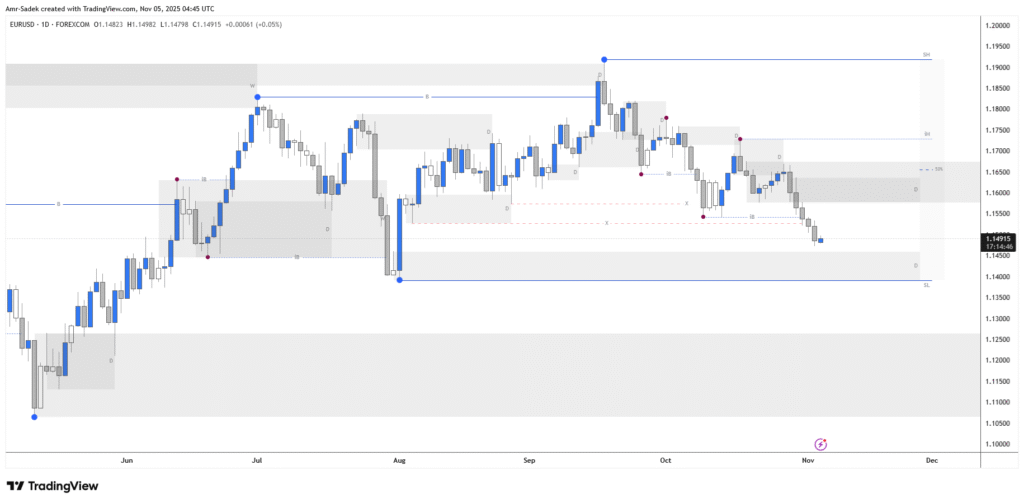

Daily Chart Markups

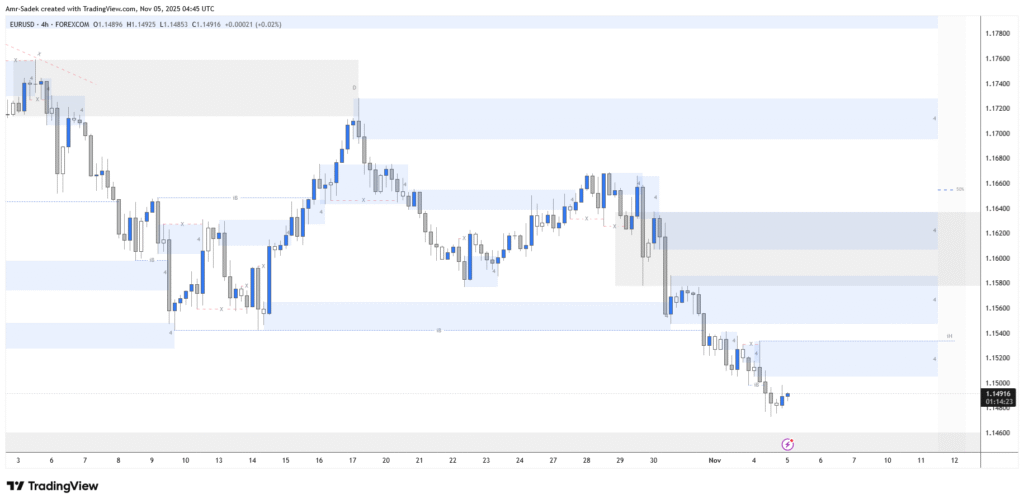

4H Chart Markups

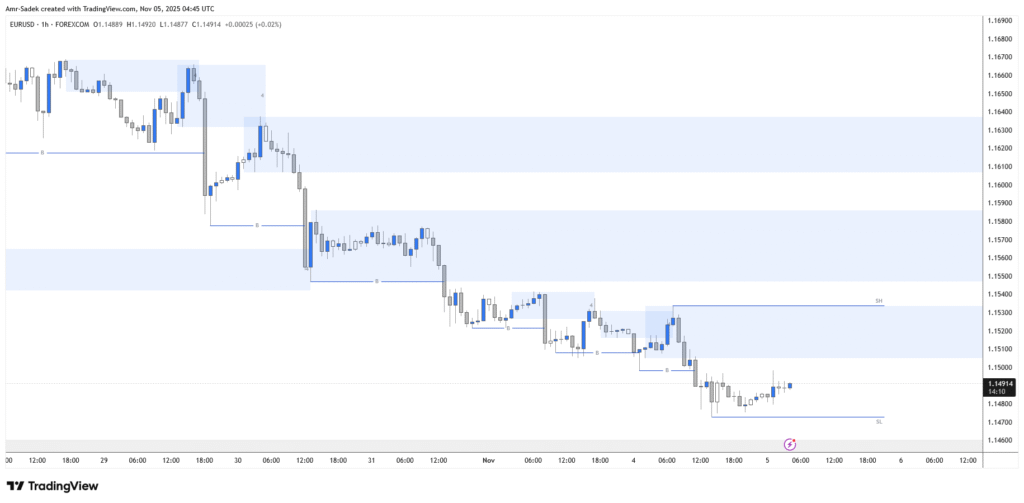

1H Chart Markups

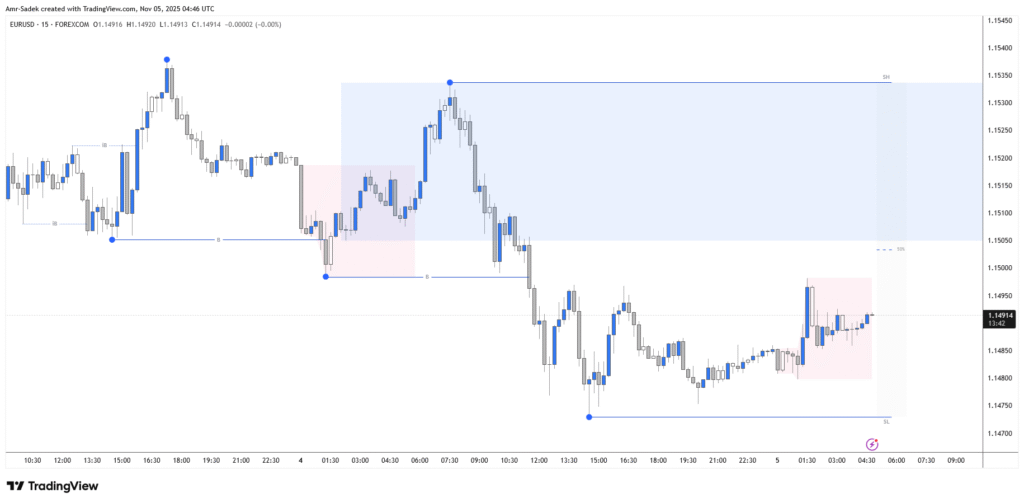

15m Chart Markups

Related Posts

- EURUSD 4 NOV 2025 W45 – Intraday Markups – EU Lagarde Speech

- EURUSD 3 NOV 2025 W45 – Intraday Markups

- EURUSD 27-31 Oct 2025 W44 – Weekly Markups – EU & US Rate Decisions Week

- EURUSD 20-24 Oct 2025 W43 – Weekly Markups

- EURUSD 23 Oct 2025 W43 – Intraday Markups