This is my Weekly Markups on EURUSD for 7 NOV 2025 W45 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Market Sentiment

The overall market sentiment remains risk-off, with investors favoring safe-haven assets like the US Dollar amid concerns over global economic slowdowns and ongoing geopolitical tensions. This caution is weighing on the Euro, as traders pull away from riskier currencies, while bolstering the Dollar as a reliable store of value. Key drivers include diverging central bank policies: the European Central Bank (ECB) is expected to maintain steady rates around 2% through late 2025 to support cooling inflation near its 2% target, signaling a more accommodative stance for the Eurozone’s tepid growth. In contrast, the Federal Reserve (Fed) has adopted a hawkish pause on further rate cuts after recent strong US employment data, like the ADP report showing better-than-expected job gains, which reinforces perceptions of US economic resilience and limits aggressive easing.

The EUR/USD pair has weakened recently due to these policy gaps, with the Euro facing sustained pressure from the ECB’s steady approach amid sluggish Eurozone activity and inflation risks from trade tariffs. Meanwhile, the Dollar is drawing support from the Fed’s firmer grip on rates and robust US data, which eases recession fears but keeps borrowing costs elevated to tame persistent inflation. This narrative of US outperformance versus European vulnerability creates a clear downward tilt for the pair, as markets bet on prolonged Dollar strength unless upcoming US jobs data surprises to the downside and prompts faster Fed easing.

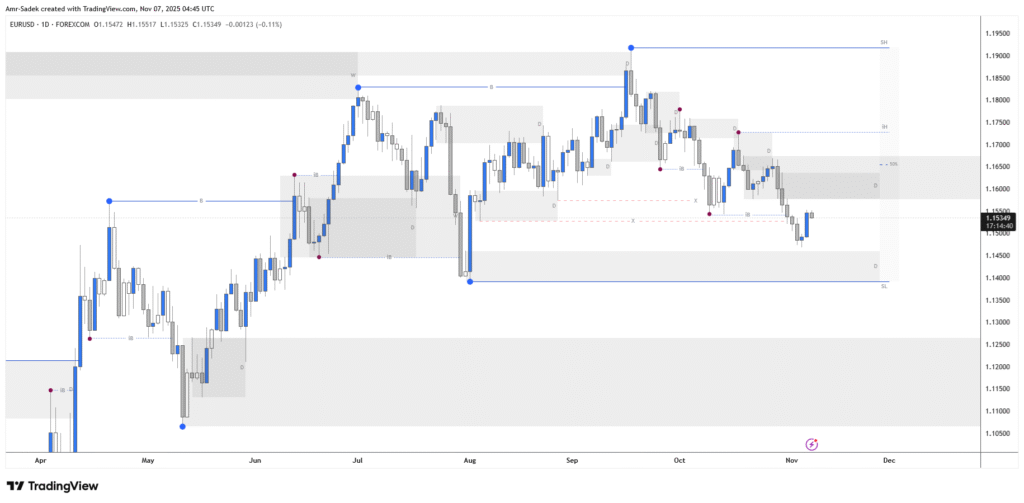

Daily Chart Markups

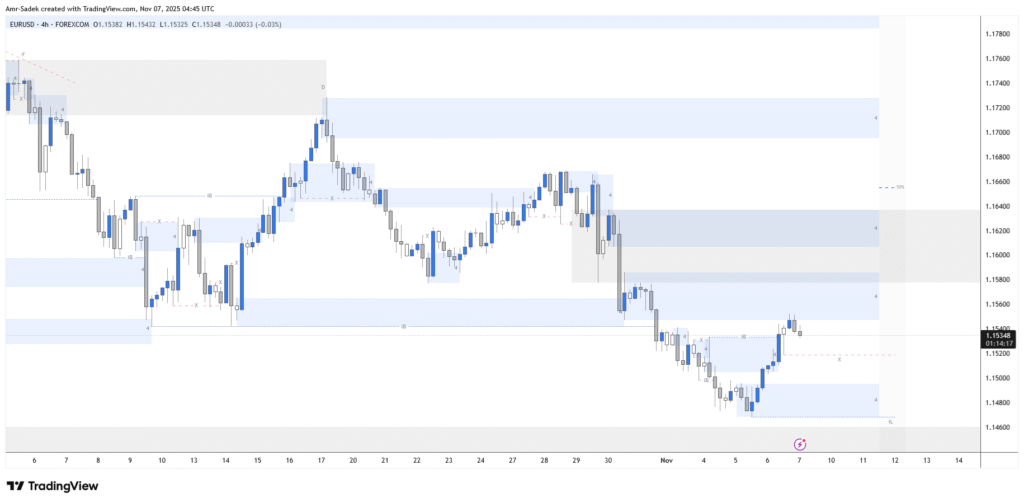

4H Chart Markups

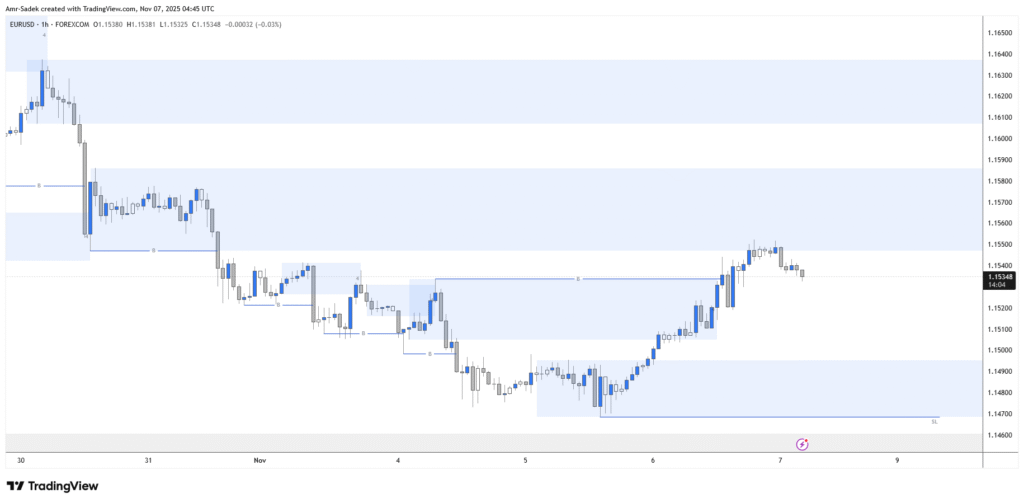

1H Chart Markups

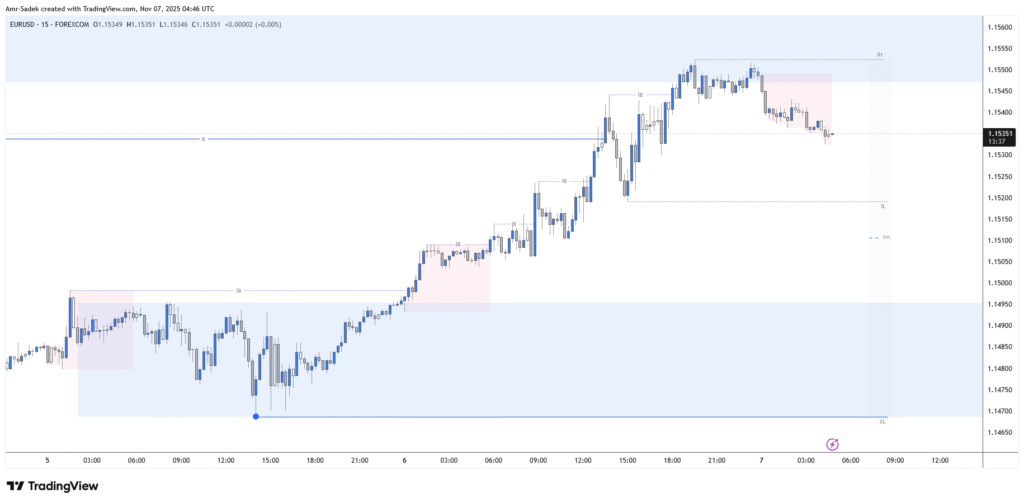

15m Chart Markups

Related Posts

- EURUSD 5 NOV 2025 W45 – Intraday Markups – EU PPI & US ADP

- EURUSD 4 NOV 2025 W45 – Intraday Markups – EU Lagarde Speech

- EURUSD 3 NOV 2025 W45 – Intraday Markups

- EURUSD 27-31 Oct 2025 W44 – Weekly Markups – EU & US Rate Decisions Week

- EURUSD 20-24 Oct 2025 W43 – Weekly Markups