This is my Weekly Markups on EURUSD for 14 OCT 2025 W42 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Current Sentiment

Overall market sentiment leans toward risk-off, driven by fresh U.S. tariff threats on China and a partial U.S. government shutdown that has heightened economic uncertainty. This cautious mood weakens the Euro, as investors pull back from European assets amid political instability in France—where a collapsed government has delayed budget plans—and softer German economic data signaling slower growth. On the U.S. Dollar side, the environment bolsters it as a safe-haven choice during volatility. Key drivers include diverging central bank outlooks: the ECB is holding rates steady at 2.15% with projections for inflation near 2% and more easing possible if growth falters, while the Fed faces pressure to cut rates further (potentially two more this year) amid sticky inflation around 0.3% monthly core readings and labor market concerns, though sticky inflation limits aggressive moves. Geopolitical trade frictions add to the mix, amplifying dollar demand.

The EUR/USD pair has seen recent weakening, trading in a contained range around the mid-1.16 area after slipping from monthly highs, as eurozone vulnerabilities outweigh U.S. policy softening. The Euro faces pressure because European growth risks and political gridlock in major economies like France and Germany erode confidence in the region’s recovery, prompting expectations of prolonged ECB easing that diminishes the currency’s appeal. Meanwhile, the Dollar finds support due to its status as a global safe haven amid escalating U.S.-China trade disputes and domestic shutdown disruptions, even as Fed rate-cut bets temper some gains—creating a narrative where short-term dollar resilience clashes with longer-term easing pressures, keeping the pair range-bound but tilted lower until European stability improves or U.S. data surprises to the downside.

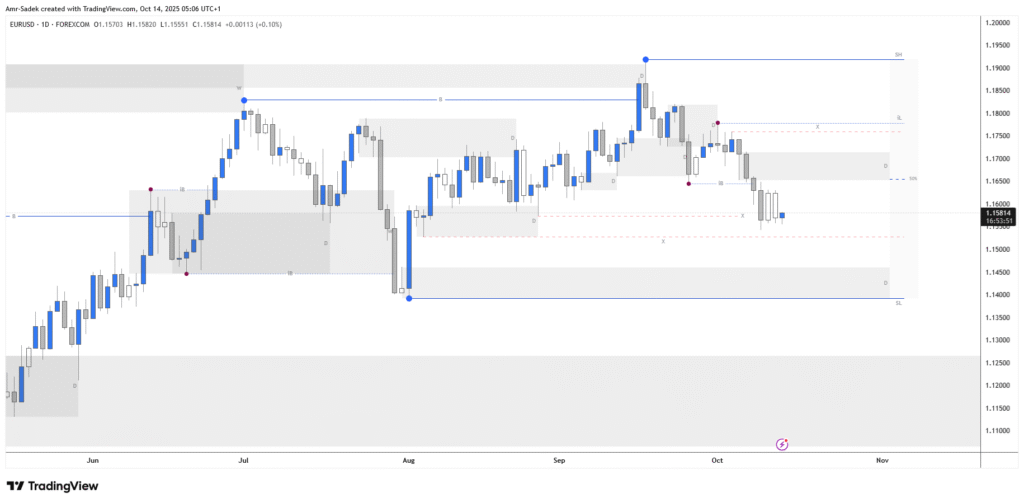

Daily Chart Markups

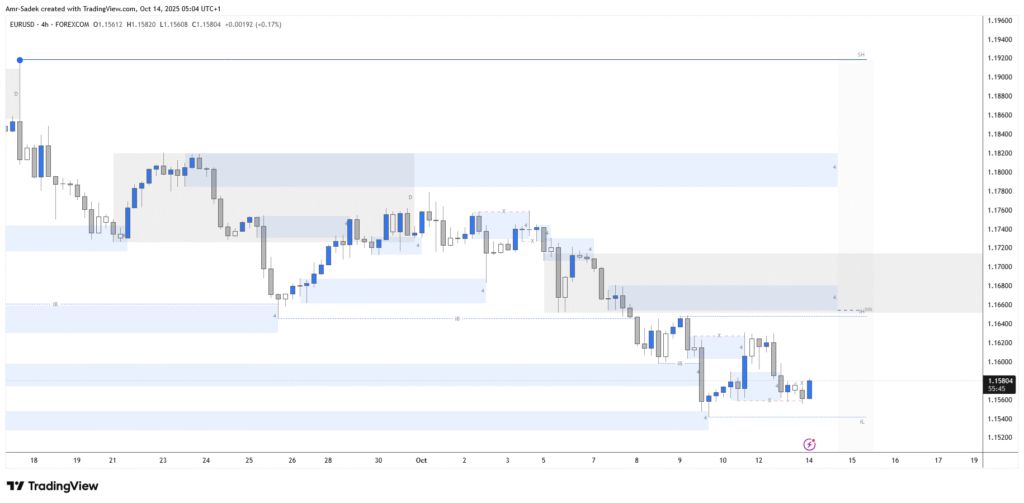

4H Chart Markups

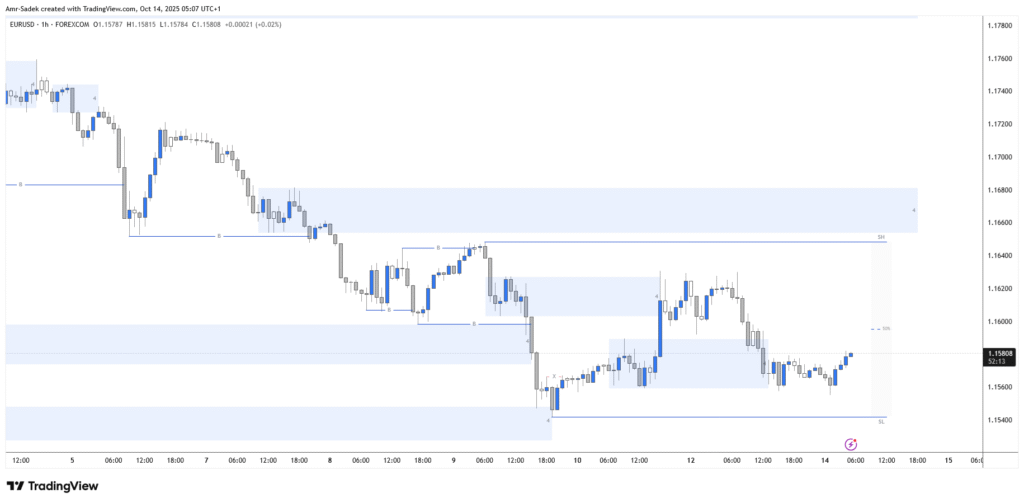

1H Chart Markups

15m Chart Markups

Related Posts

- EURUSD 13 Oct 2025 W42 – Intraday Markups

- EURUSD 13-17 Oct 2025 W42 – Weekly Markups

- EURUSD 10 Oct 2025 W41 – Intraday Markups

- EURUSD 9 Oct 2025 W41 – Intraday Markups – US Unemployment Claims & Powell Speaks

- EURUSD 8 Oct 2025 W41 – Intraday Markups – FOMC Meeting Minutes

Latest Weekly Analysis

- EURUSD 13-17 Oct 2025 W42 – Weekly Markups

- EURUSD 6-10 Oct 2025 W41 – Weekly Markups

- EURUSD 24-28 Feb 2025 W9 – Weekly Analysis – US GDP / PCE Week!

- EURUSD 17-21 Feb 2025 W8 – Weekly Analysis – EU ZEW – US FOMC minutes & PMI

- EURUSD 10-14 Feb 2025 W7 – Weekly Analysis – US CPI/PPI/Powell & EU GDP/Lagarde & Tariffs!

- EURUSD 3-7 Feb 2025 W6 – Weekly Analysis – Tariffs Impact & NFP Week