This is my Weekly Markups on EURUSD for 16 OCT 2025 W42 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Current Sentiment

The current market sentiment leans toward risk-off, with investors pulling back from higher-risk assets due to escalating US-China trade tensions and broader geopolitical uncertainties, including ongoing conflicts in Europe. This cautious mood strengthens the US Dollar as a safe-haven currency, while it weighs on the Euro, which is more tied to global trade and growth-sensitive sectors. Key drivers include diverging central bank policies: the Federal Reserve is expected to continue gradual rate cuts to support a softening US labor market, but recent sticky inflation data has tempered aggressive easing bets, bolstering the Dollar. In contrast, the European Central Bank has held rates steady amid cooling eurozone inflation nearing its 2% target and subdued growth, leaving the Euro vulnerable. Recent economic releases, like solid US bank earnings offset by weaker consumer sentiment and mixed Eurozone PMI data showing tentative recovery, reinforce this divide, alongside warnings of potential US tariffs adding to global volatility

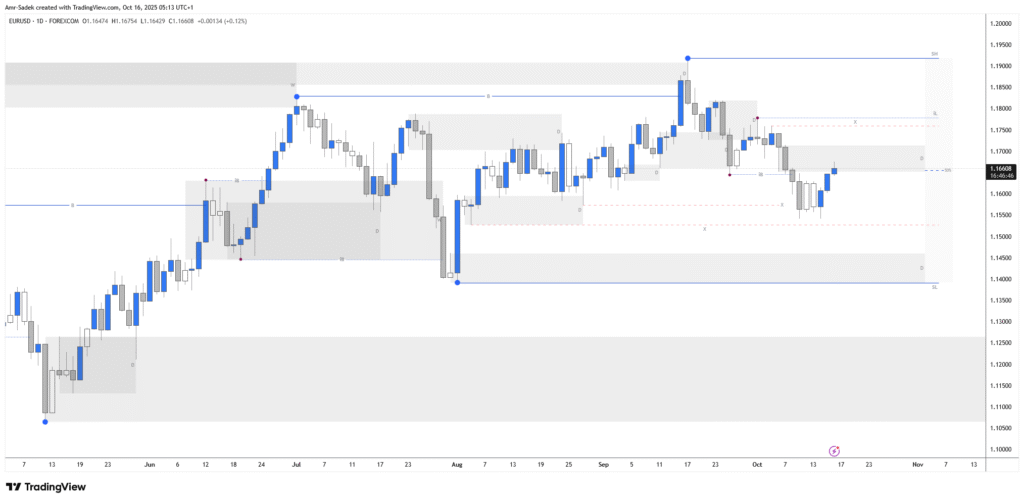

Daily Chart Markups

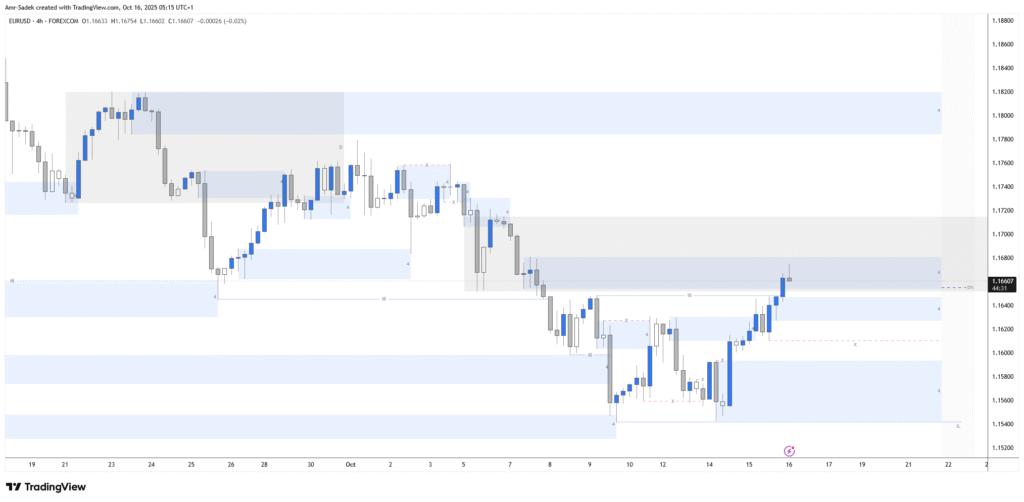

4H Chart Markups

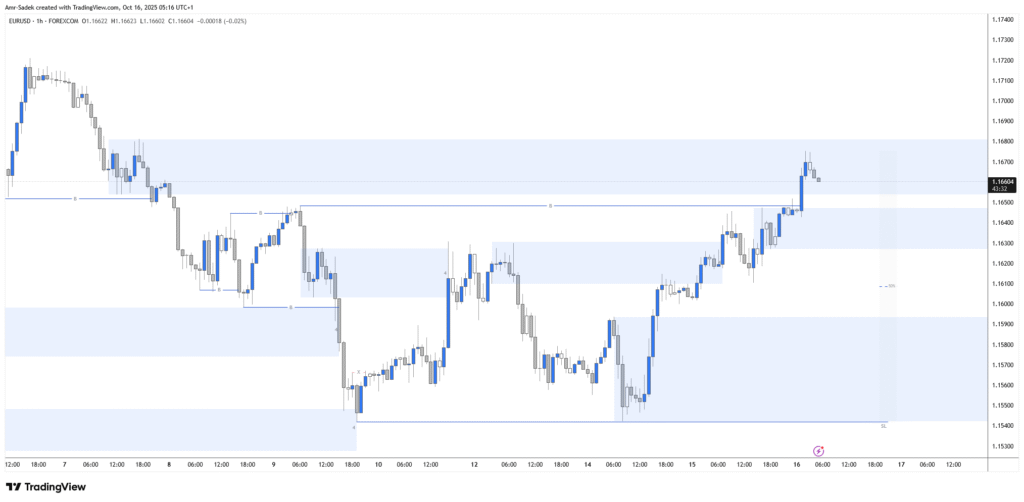

1H Chart Markups

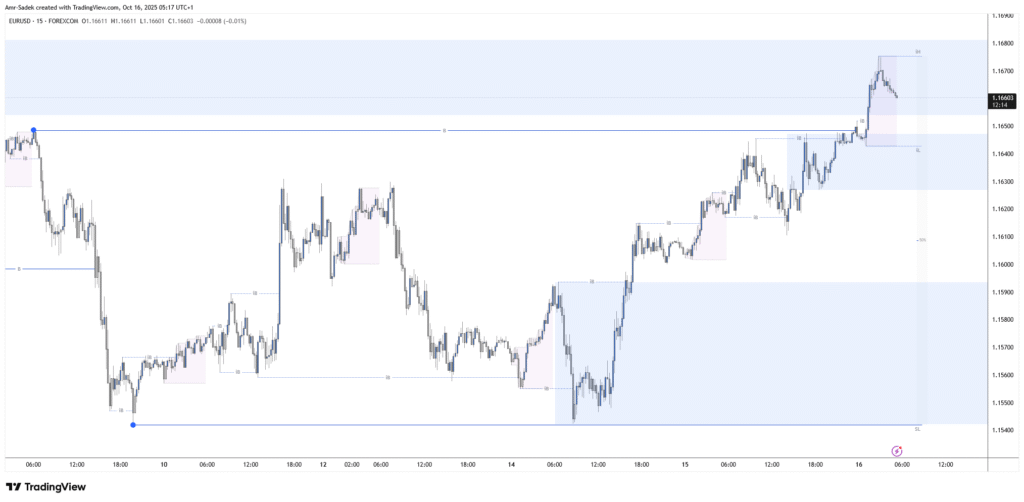

15m Chart Markups

Related Posts

- EURUSD 15 Oct 2025 W42 – Intraday Markups – US Beige Book

- EURUSD 14 Oct 2025 W42 – Intraday Markups – EU ZEW & US Powell Speaks

- EURUSD 13 Oct 2025 W42 – Intraday Markups

- EURUSD 13-17 Oct 2025 W42 – Weekly Markups

- EURUSD 10 Oct 2025 W41 – Intraday Markups

Latest Weekly Analysis

- EURUSD 13-17 Oct 2025 W42 – Weekly Markups

- EURUSD 6-10 Oct 2025 W41 – Weekly Markups

- EURUSD 24-28 Feb 2025 W9 – Weekly Analysis – US GDP / PCE Week!

- EURUSD 17-21 Feb 2025 W8 – Weekly Analysis – EU ZEW – US FOMC minutes & PMI

- EURUSD 10-14 Feb 2025 W7 – Weekly Analysis – US CPI/PPI/Powell & EU GDP/Lagarde & Tariffs!