This is my Weekly Markups on EURUSD for 15 OCT 2025 W42 based on Smart Money Concept (SMC) which includes the following:

Table of Contents

Current Sentiment

The overall market sentiment leans risk-off, with investors favoring safe-haven assets amid escalating trade tensions between the US and China, a US government shutdown delaying key economic reports, and political instability in France following the collapse of its government. This cautious mood weakens the Euro, as Eurozone growth remains sluggish with recent data showing a decline in the Leading Economic Index and deteriorating economic sentiment in Germany. In contrast, the US Dollar holds firmer as a traditional refuge, bolstered by resilient US economic fundamentals despite policy uncertainties. Dominant themes include diverging central bank paths—the European Central Bank (ECB) has paused rate cuts at 2.00% with inflation near its 2% target, signaling a potential end to easing, while the Federal Reserve (Fed) faces expectations for two more cuts this year amid sticky inflation around 3% and a softening labor market. Geopolitical risks, such as US tariff threats and fiscal worries, further amplify this divide, with upcoming US CPI data on October 24 poised to influence Fed decisions.

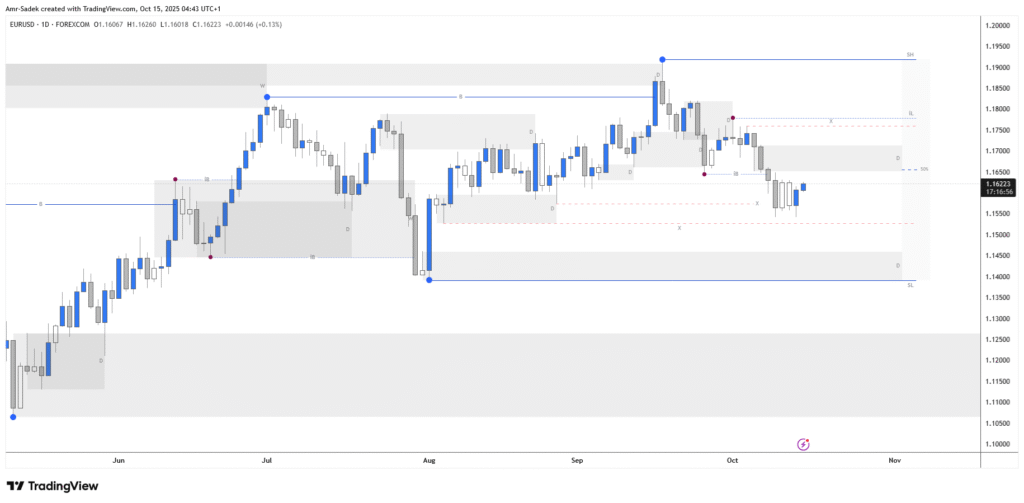

Daily Chart Markups

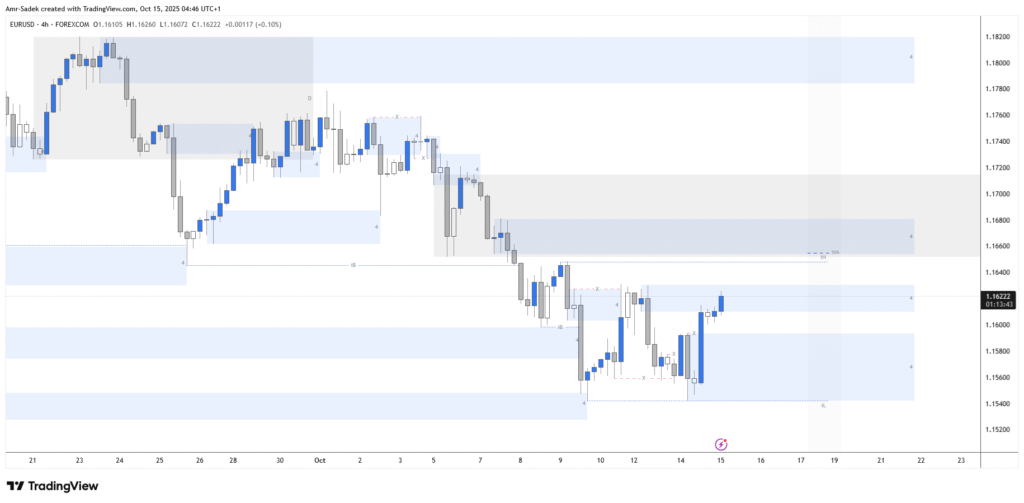

4H Chart Markups

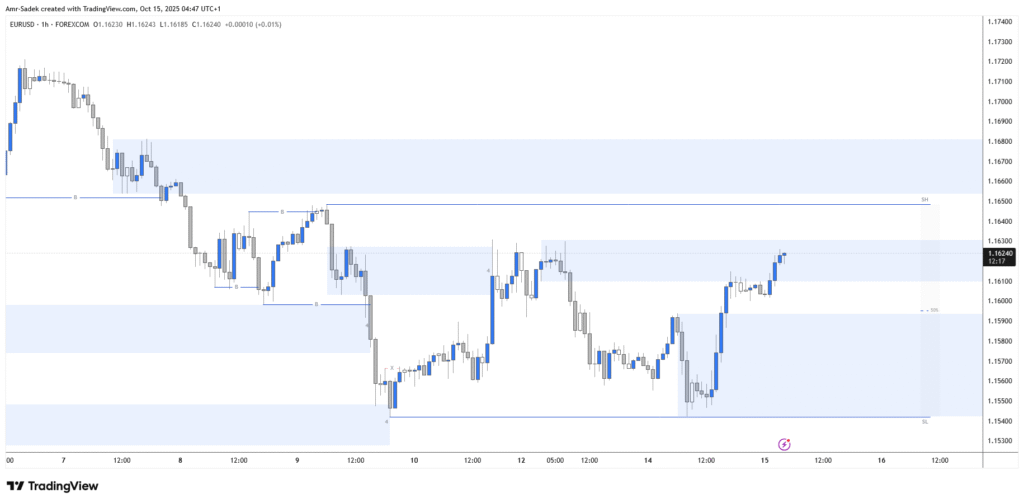

1H Chart Markups

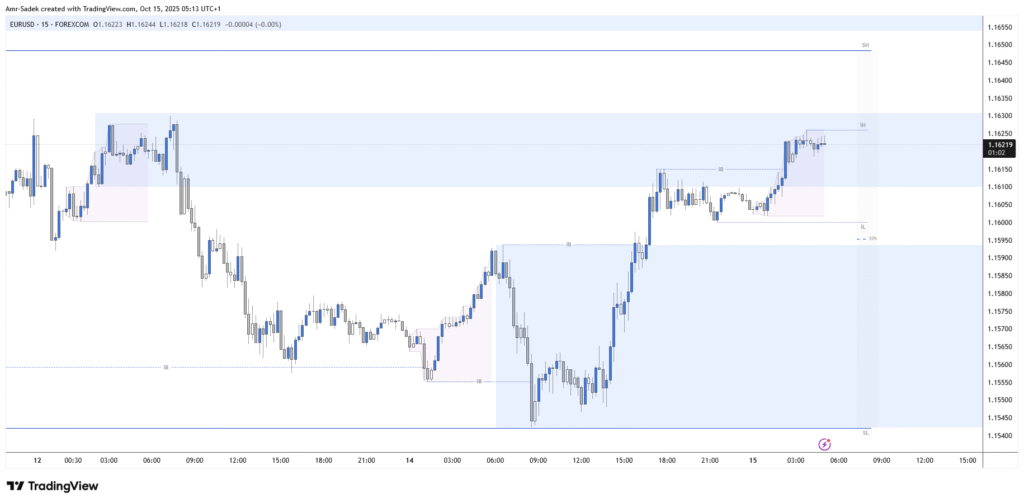

15m Chart Markups

Related Posts

- EURUSD 14 Oct 2025 W42 – Intraday Markups – EU ZEW & US Powell Speaks

- EURUSD 13 Oct 2025 W42 – Intraday Markups

- EURUSD 13-17 Oct 2025 W42 – Weekly Markups

- EURUSD 10 Oct 2025 W41 – Intraday Markups

- EURUSD 9 Oct 2025 W41 – Intraday Markups – US Unemployment Claims & Powell Speaks

Latest Weekly Analysis

- EURUSD 13-17 Oct 2025 W42 – Weekly Markups

- EURUSD 6-10 Oct 2025 W41 – Weekly Markups

- EURUSD 24-28 Feb 2025 W9 – Weekly Analysis – US GDP / PCE Week!

- EURUSD 17-21 Feb 2025 W8 – Weekly Analysis – EU ZEW – US FOMC minutes & PMI

- EURUSD 10-14 Feb 2025 W7 – Weekly Analysis – US CPI/PPI/Powell & EU GDP/Lagarde & Tariffs!